Even a dummy can figure out that this is the best funding option for any business. Your broker pays the factoring company in 30-45 days. You submit your paperwork to the factoring company rather than the broker. You haul a load from one place to the other. More importantly, they don’t check your credit until you decide to move forward and they don’t ask for personal guarantees (except in cases of fraud). Freight factoring does one simple thing: it pays you faster for work you’ve already done. For most businesses, you can get your money in 72 hours or less. In fact, the entire process, from start to finish, can all happen in the same day. This is the kind of finance for dummies that anyone can understand.

Their online application takes just minutes to complete. With help from Financing Solutions ( you can get this short term business funding quickly. It’s ideal for emergency business funding or to manage the inevitable uneven cash flow common to most small businesses. You can draw from it for everything from making payroll to taking advantage of new business opportunities. It also may be problematic to use it as the collateral that most lenders require.Ī line of credit from Financing Solutions – this is a set amount of money that you can borrow from whenever you need it.

Factoring invoices for dummies full#

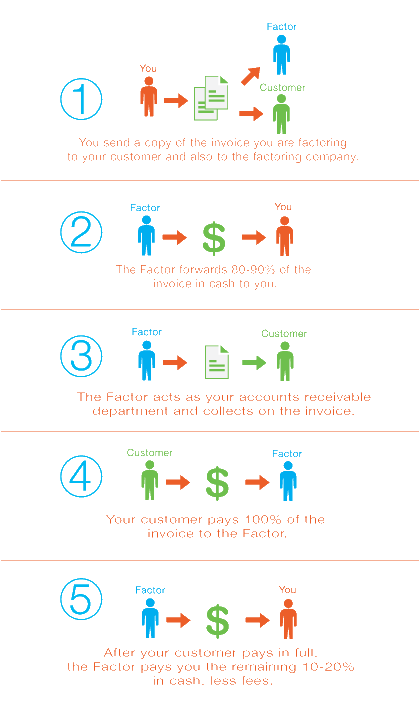

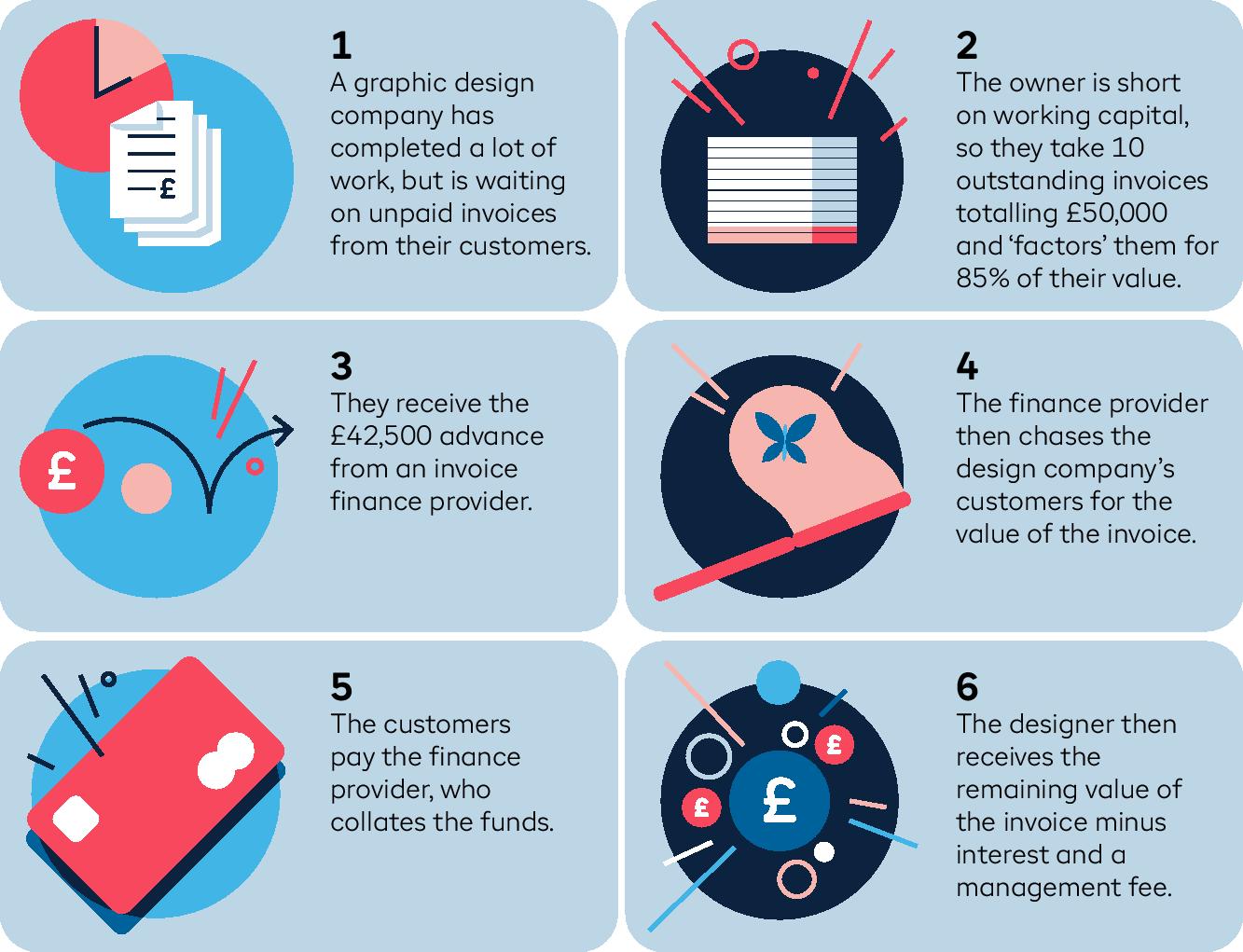

Yet, since they don’t actually own it in full right now, this makes recording the item tricky. In most cases, they will eventually own the asset. Leasing prevents tying up money with a major, expensive purchase. Leasing – businesses that don’t buy their fixed assets typically lease them. Many banks have a separate asset finance operation to handle this type of small business funding. And no one wants to stick with a sinking ship.Īsset based lending – if you have resources like equipment or real estate, you can borrow against it. Invoice factoring allows a business to grow and unlock cash that is tied up in future income, so that it can re-invest that capital and time is not spent. The downside is that the factor will contact your clients, basically letting them know that your company is struggling. Factoring your invoices is a funding option that will give you some business cash now. If your business works a lot with invoices, then you probably give your customers 30, 60 or 90 days to pay. A lending company, or factor, will purchase these debts and give you a portion of their value upfront. In addition, you must provide tons of paperwork and proof that you can pay the money back.įactoring – this is when you use future monies that your clients owe to help fund your business. Since banks use other people’s money to make business loans, they don’t like to take risks by working with small businesses. However, small business loans are tough to qualify for. While this may keep you in debt for a longer period, you can also keep more cash in your pocket with smaller payments that can stretch out for several years. What Are the Different Types of Finance for Dummies (and the Smart)?īusiness loans – probably the most common option for borrowing money. This is the only way to discover what’s right for your business. And you are not alone.ī ut you must be able to grasp various concepts concerning small business financing. You may wonder if you should read finance for dummies. The problem is that’s it is all so confusing. It might be a line of credit, business loan, account receivable factoring, leasing or other forms of financing. Why Finance for Dummies (and not so dummies) is So ImportantĮvery business owner encounters situations where they have to look at financing for their business. It doesn’t necessarily mean you need finance for dummies. Truthfully, there are just some people whose minds can understand finance while others find it difficult to understand key business concepts.

169628.They say that any dummy with a half decent idea can become a millionaire so why do you feel like you need finance for dummies? Actually, you’re not a dummy at all.

Factoring invoices for dummies registration#

Bank of Scotland plc is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority under registration no. Registered Office: The Mound, Edinburgh EH1 1YZ. Lloyds Bank plc is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority under registration number 119278. Registered Office: 25 Gresham Street, London EC2V 7HN. Registered office: No.1, Brookhill Way, Banbury OX16 3EL.

Calls may be monitored or recorded in case we need to check we have carried out your instructions correctly and to help improve our quality of service.įactoring and Invoice Discounting facilities may be provided by one or more of Lloyds Bank Commercial Finance Limited, Lloyds Bank plc and Bank of Scotland plc.

0 kommentar(er)

0 kommentar(er)